TrueMarkets Review

TrueMarkets Review

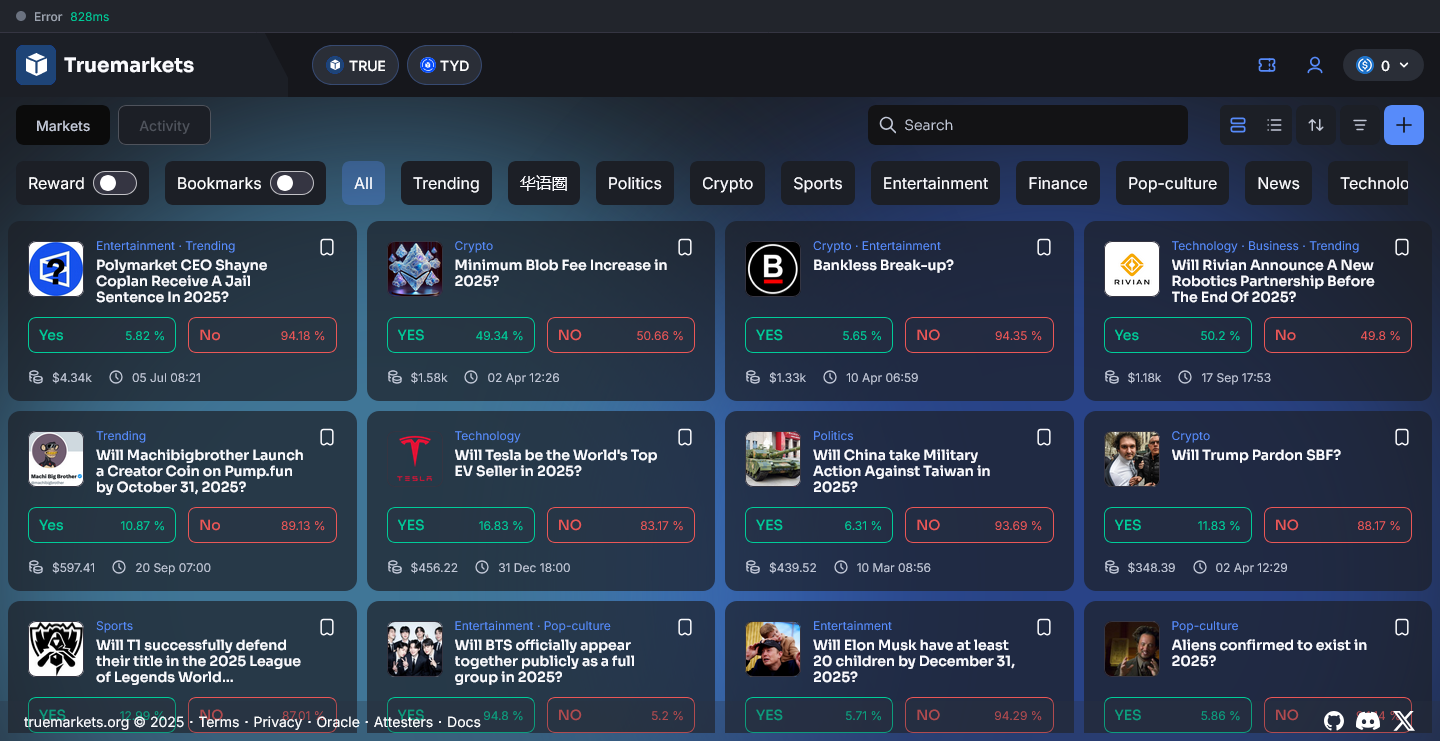

Market Categories

Users cannot create their own markets on this platform. All markets are created and managed by the team.

TrueMarkets Analysis

TrueMarkets Review – BitGamble

TrueMarkets Overview

TrueMarkets is a decentralized crypto prediction market which allows users to bet on certain market events using stablecoins. Each market is framed as a simple Yes/No question such as “Will Bitcoin reach a new all-time high this year?”. You can buy shares of ‘YES” or that of ‘NO’ with prices ranging between $0 and $1 per share reflecting the market’s perceived probability. If your prediction is correct, your tokens redeem for $1 each if not they become worthless. So for example, if you buy $100 worth of “YES” when the price is at $0.40 per share, which gives you 250 shares, and if you’re right when the event resolves, you get paid $250.

Launched in late 2024, TrueMarkets runs fully on chain via Uniswap liquidity pools on the Base network, meaning it is decentralized and never holds your funds. Bets are executed as token swaps in a decentralized pool, giving the platform a DeFi like structure rather than a traditional sportsbook. Its goal is to let anyone trade on outcomes directly from a crypto wallet without the use of a bookie or a middleman

Thsis project received early attention due to Vitalik Buterin bridging ETH to mint “Oracle Patron” NFTs tied to the platform. These NFTs later became part of the $TRUE token distribution and governance model. TrueMarkets could be debated as one of the most advanced projects in the GambleFi prediction space as it combines DeFi mechanics, AI-augmented oracles, and community-governed markets.Tr

TrueMarkets Features

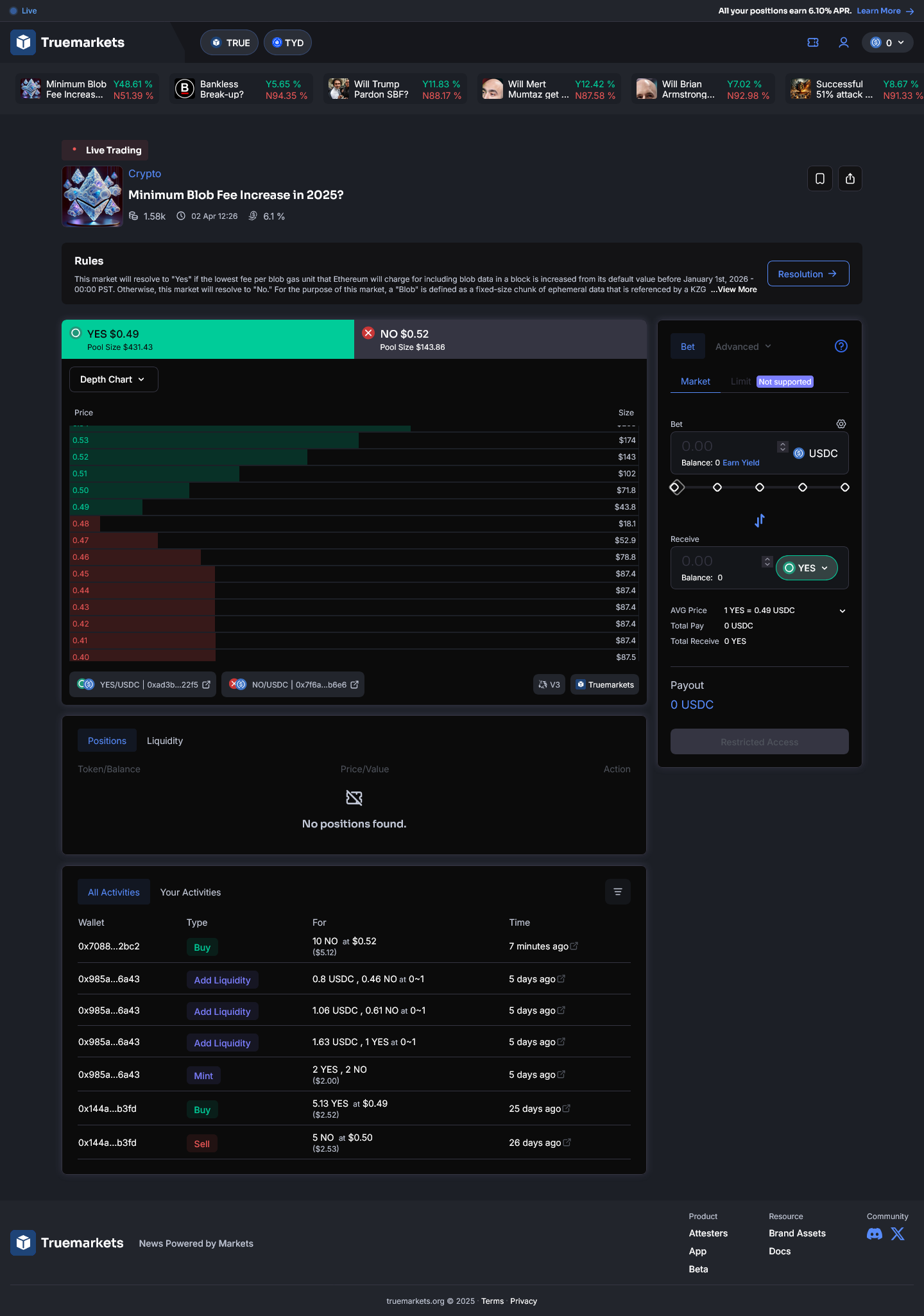

TrueMarkets is a combination of DeFi, AI, and decentralization. The entire platform works fully on-chain, using Base as its L2 blockchain of choice, all trades and payouts are powered by smart contracts. TrueMarkets never takes control of player funds, every bet happens directly between users through liquidity pools, the process is transparent and removes the need for a middleman. There is no ‘house’ or bookmaker that fixates the odds, instead each market evolves dynamically similar to how Uniswap works, as more traders buy the “YES” share that outcome’s price rises while “NO” falls, mirroring real market sentiment. This allows TrueMarkets users to enter and exit positions at anytime, which feels more like active trading than traditional betting.

TrueMarkets uses an AI powered oracle that determines market outcomes, it is one of the more creative solutions the platform offers. It uses an optimistic oracle model where anyone can propose results once an event ends, and those are accepted automatically unless challenged within a dispute window. TrueMarkets goes a step further by integrating AI agents alongside human resolvers to assist with market verification and even creation, a kind of hybrid model that combines automation and community oversight to ensure fair and unbiased resolutions.

Holders of the $TRUE token and the Oracle Patron NFT collection can participate in governance decisions through the Oracle Council, voting on future updates, oracle policies, and fee structures. While normal users won’t need the token to use the platform, their native token is just used for governance purposes.

Beyond its DeFi core, TrueMarkets also aims to merge prediction trading with media, similar to what Myriad Market is doing. The team is developing integrations that will allow markets to appear directly inside news articles or social feeds, for example, letting a reader place a wager on a political outcome without leaving the page. If successful, this “market-based media” concept could help prediction markets reach mainstream audiences and turn headlines into interactive experiences.

Supported Crypto and Wallets

TrueMarkets operates only on Base, an Ethereum Layer-2 chain known for fast and low-fee transactions. Most trading and settlements use USDC as the base currency, while others use TYD, a stablecoin powered by Yearn, it is the yield bearing token of TrueMarkets which rewards users with ~6.29% APR as of October 2025 by holding or maintaining positions in prediction markets.

To join the action, the steps are simple, you connect a Web3 wallet such as MetaMask, Coinbase Wallet, or Rainbow, switch to the Base network, and fund it with USDC, which will automatically show as your balance.

There’s no registration or KYC your wallet is your account. The platform is non-custodial, funds and bets are self managed directly from your wallet you don’t have to deposit or withdraw like on centralized casinos. You simply swap USDC for YES/NO tokens to open a position, and when the event ends , you redeem your winning tokens back to USDC instantly.

You can bridge funds from Ethereum or another chain to Base to get started and once set up, Base’s gas fees are just a few cents, making trades fast and affordable even for smaller wagers.

User Experience and Trading

The interface is sleek and simple, it combines the simplicity of a sportsbook with the depth of a DeFi dashboard. Each market is grouped under categories like Crypto, Politics, Sports, and World Events. Each listing shows current odds, Liquidity and the resolution date; clicking in opens a detailed view with charts, liquidity, betting options and trade history.

TrueMarkets uses an AMM ( automated market maker) as its engine, which ensures trades execute instantly without waiting for another user to match. Prices shift dynamically as users buy and sell, mirroring market sentiment. The Trading fees are very minimal, typically around 0.3% per transaction, paid directly to liquidity providers, and since its powered and operates on Base the network gas costs are just a few cents per trade. There are no deposit or withdrawal fees, as everything happens on-chain through your own wallet.

The site features a Portfolio tab which you can use to check open positions and unrealized profit/loss. It’s responsive on mobile browsers and works smoothly through wallet-based dApp browsers, though desktop provides the best full-chart view.

KYC and Privacy

TrueMarkets is completely no-KYC. You can start trading immediately by just using your web3 wallet— no ID, no email, no account forms, which makes it attractive for any crypto player that values anonymity.

Your bets are visible on-chain but only tied to wallet addresses, not personal data. There are no withdrawal limits or personal verification requirements since TrueMarkets is fully non custodial.

The protocol doesn’t geo-block users, though it advises to not use the platform if gambling is banned in your country. Like most decentralized apps, participation is at your own risk, but the model enables freedom and pseudonymity rarely seen in gambling platforms.

Decentralization and Custody

TrueMarkets’ is almost fully decentralized, it promotes self-custody and transparency, as all funds stay in your wallet or in smart contracts you directly interact with. Even if the website went offline, your tokens remain retrievable through the Base blockchain.

Market resolutions use an optimistic oracle mechanism. When an event concludes, anyone can propose the outcome directly to the blockchain by posting a bond which is usually a few dollars worth of crypto that serves as a proof of hoesnty. If no disputes occur, that result becomes final; if challenged, the dispute escalates to the Oracle Council, a mix of community members and AI agents that verify the outcome. This prevents manipulation and keeps the process trust-minimized.

Currently, market creation is limited to approved creators or council members can list new events, but full community market creation is planned once the oracle governance matures.

TrueMarkets Final Analysis

After testing and analyzing TrueMarkets, we can say it’s one of the most promising new entrants in the decentralized prediction market space. We were particularly impressed by the level of clarity and transparency of the experience as a whole. You connect a wallet -> place your prediction, and everything else happens automatically on-chain. There are no deposits get stuck while having to wait for support to solve it, no endless KYC paperwork, and no intermediaries that charge a fee. It’s fast, permissionless, and built for crypto users.

The AI-enhanced oracle system is an impressive, if not bold, step. TrueMarkets incorporates human verifiers alongside algorithmic verification to provide an added level of fairness and automation that we haven’t seen in most competitors. It’s still early, but if this hybrid oracle model works as intended, it could set a new standard for how decentralized predictions are resolved.

From a trading perspective, the platform feels modern and lightweight. Markets update in real time, however liquidity is smaller than other crypto prediction markets such as Polymarket but that’s expected for a young project still growing its user base. Fees are minimal, payouts are instant, and everything stays fully non-custodial, these are big pluses in our book.

There are areas where TrueMarkets can improve, so far its only available on Base, which might limit newcomers who aren’t familiar with using L2 networks or with bridging, and we’d like to see user-generated markets become available sooner rather than later. The upcoming media integrations sound exciting, but they’re still on the roadmap, it would be interesting to see how they might implement it and if it would be a better option than Myriad.

Overall, TrueMarkets gets a strong vote of confidence from us. It combines the technical depth of DeFi with the simplicity of prediction betting in a way that feels natural. The privacy-first, no-KYC approach, fair fee structure, and clear roadmap make it a serious contender in the GambleFi space. While it’s not perfect yet, it’s heading in the right direction, and for those who like transparency, ownership, and control over their bets, TrueMarkets is absolutely worth keeping an eye on.

/rating_on.png)